The funding awarded by the “Rising Restaurateur: A Community Grant Program” will support and strengthen local Latino, Black, Indigenous and AAPI restaurateurs in New York City

NEW YORK – Aug. 6, 2024—On Monday, Aug. 5, Grubhub, Oyate Group and the New York State Latino Restaurant, Bar & Lounge Association (NYSLRBLA) announced 30 restaurants from Manhattan, Brooklyn, Queens, The Bronx and Westchester County as the inaugural recipients of “Rising Restaurateur: A Community Grant Program.” Each restaurateur was awarded a $6,500 microgrant and will receive business development training provided by the anti-poverty nonprofit Oyate Group in an effort to support independent Latino, Black, Indigenous and AAPI restaurateurs.

“The Rising Restaurateur grant program is a lifeline for our city’s small and minority-owned restaurants, helping them cover essential costs, invest in growth and drive innovation, said Sandra Jaquez, president of the New York State Latino Restaurant, Bar & Lounge Association. “With this critical funding, restaurants will have the opportunity to better serve their communities and support positive change in our industry. We are immensely grateful to Grubhub and Oyate for their unwavering support and partnership.”

NYSLRBLA President Sandra Jaquez hosted an award ceremony at her Italian restaurant, Il Sole, where representatives of Grubhub, Oyate Group and NYSLRBLA, as well as members of Congress, NYC Council, and the Chambers of Commerce, offered remarks congratulating the local and independent restaurateurs who serve as the backbone of New York City’s local economy. Notable guests in attendance included U.S. Representative Adriano Espaillat (NY-13) and representatives from New York State Assemblymember Manny De Los Santos’ office (Assembly Dis. 72).

“We at Oyate Group are proud to have been able to invigorate thirty independent restaurants at the heart of our communities with the help of our invaluable partners,” said Tomas Ramos, president, CEO and founder of Oyate Group. “Latino, Black, Indigenous and AAPI restaurateurs make New York City one of the most diverse and vibrant culinary capitals in the world, which is why it is so important to provide them with the financial support and guidance they need to thrive and continue uplifting our neighborhoods.”

Rising Restaurateur is a partnership between Oyate Group, a nonprofit with the mission to alleviate poverty, Grubhub, an online food delivery marketplace, and NYSLRBLA, a nonprofit organization founded to create opportunities for Latino and minority businesses to succeed in the food and beverage industry. Oyate Group and Grubhub have pledged to continue funding the program annually until 2026.

“The 2024 Rising Restaurateur grant recipients, like the majority of the restaurants that Grubhub serves, are small and medium-sized businesses that we believe are critical players in neighborhoods and communities across NYC,” said Brett Swanson head of Community Affairs at Grubhub. “Supporting independent restaurants is a primary focus for Grubhub’s community impact work, and we are honored to help give these 30 small businesses an extra boost to help sustain and grow their operations.”

The complete list of the 2024 Rising Restaurateur grant recipients listed by borough is as follows:

- The Bronx: Rosa’s At Park, Mon Amour Coffee & Wine, Cafe Colonial Restaurant and Grill, La Cocina de Yala LLC, Chocobar Cortes, Colima Taqueria

- Brooklyn: Taqueria el Patron Mexican Grill, Salud Bar & Grill, Halsey Ale House, Hello Bar LLC, Mez En Place, Citrico

- Manhattan: Tabu Restaurant, EL Jefe, Il Posto Accanto, 7 Henshaw Inc, Bocaditos Bistro, Indian Summer Harlem, Pate Palo Bar & Grill, Healthy in Dyckman Juice Bar and Cafe

- Queens: Turkish Grill, Flamingo, Fonda La Consentida, Mojitos Restaurant Bar, Bramo’s Express, Multisweet LIC, Canas Restaurant and Bar Corp, Bocaito Café, The Nourish Spot

- Westchester: El Cantito Café

For more information about Rising Restaurateur, please visit https://oyategroup.org/rising-restaurateur. For any media inquiries about Rising Restaurateur, please contact Emiliano Garcia at (917) 446-7571 or emiliano@thetascgroup.com.

About Oyate Group

Oyate Group is a Bronx-based nonprofit with the mission to alleviate poverty through sustainable and holistic solutions that empower underserved communities across New York City and close resource gaps for New Yorkers. Oyate Group’s programs and initiatives focus on youth development, small business empowerment, food accessibility, gun violence prevention and more. Oyate Group is nationally recognized for vaccinating over 40,000 New Yorkers at the height of the pandemic, its one-of-a-kind paid internship program for undocumented youth, a small business incubator offering up to $50,000 to local entrepreneurs, a $20,000 scholarship for Bronx youth headed to college, a leadership program for high schoolers, annual turkey giveaways, backpack giveaways and gun buyback programs. For more information, visit OyateGroup.org, and follow Oyate Group on Instagram, Twitter and LinkedIn.

About Grubhub

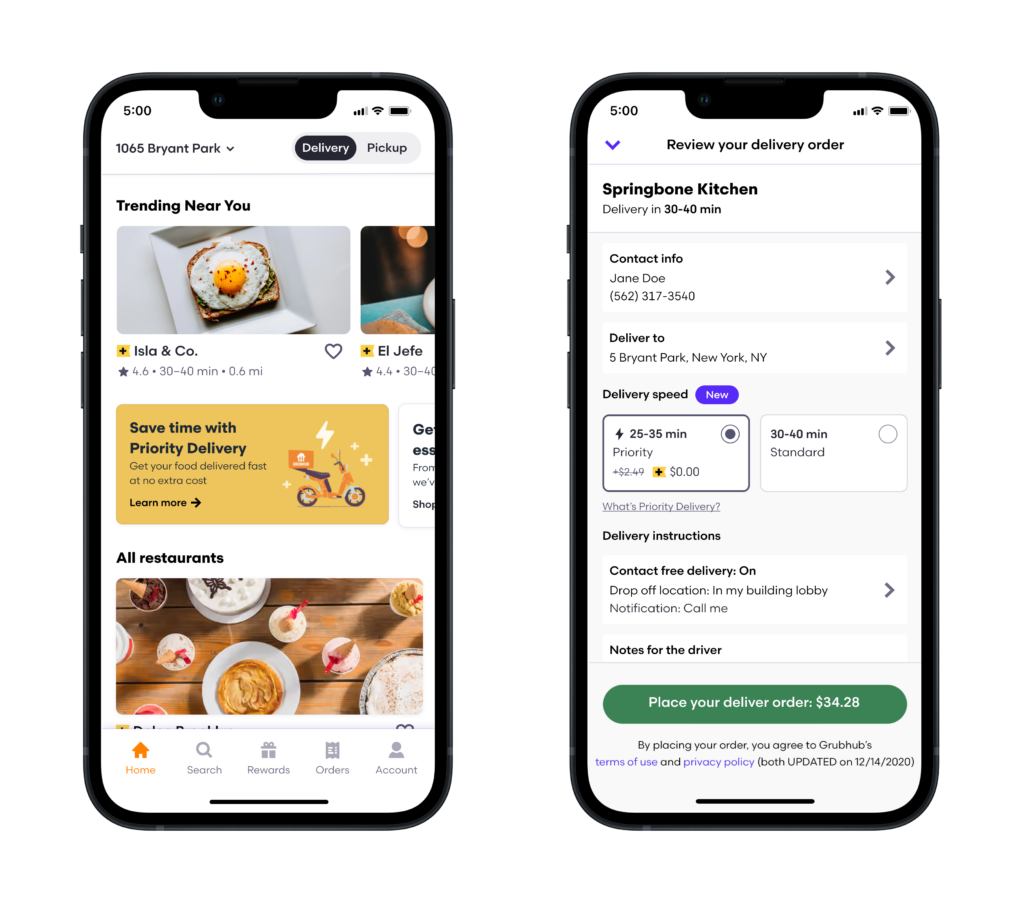

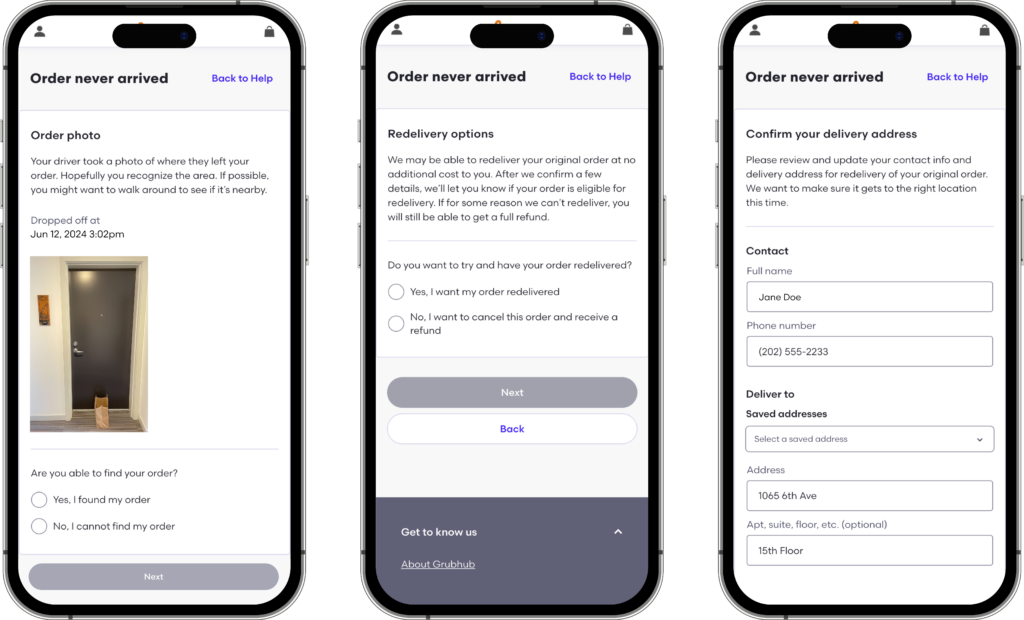

Grubhub opened its doors in Chicago in 2004, founded on the belief that it could create opportunities for local businesses to grow by connecting food from the best restaurants with the people who love it most. Over the past two decades, Grubhub has supported two billion orders and served nearly 100 million consumers while providing delivery partners with opportunities to earn. Today, Grubhub is a part of Just Eat Takeaway.com (LSE: JET, AMS: TKWY), featuring 375,000 restaurant, convenience and grocery merchants in over 4,000 U.S. cities.

About New York State Latino Restaurant, Bar & Lounge Association

The NYS Latino Restaurant, Bar & Lounge Association (“NYSLRBLA”) is a 501(c)6 non-profit organization founded for the purpose of helping Hispanic and minority businesses succeed in commerce and industry, particularly, that of the food and beverage industry. NYSLRBLA is one of the largest business organizations of its kind with over 350 restaurant members to date, ranging from individual Latino businessmen/women owning fast food establishments to gourmet larger restaurants to lounges and bars within the tri-state area.